Advanced Transactions and Scripting

Introduction

In the previous chapter, we introduced the basic elements of bitcoin transactions and looked at the most common type of transaction script, the P2PKH script. In this chapter we will look at more advanced scripting and how we can use it to build transactions with complex conditions.

First, we will look at multisignature scripts. Next, we will examine the second most common transaction script, Pay-to-Script-Hash, which opens up a whole world of complex scripts. Then, we will examine new script operators that add a time dimension to bitcoin, through timelocks.

Multisignature

transactionsadvancedmultisignature scripts advancedmultisignature

scripts multisignature scriptstransactionsadvanced

advancedscriptingmultisignature scripts multisignature

scriptsmultisignature scriptsMultisignature scripts set a condition

where N public keys are recorded in the script and at least M of those

must provide signatures to unlock the funds. This is also known as an

M-of-N scheme, where N is the total number of keys and M is the

threshold of signatures required for validation. For example, a 2-of-3

multisignature is one where three public keys are listed as potential

signers and at least two of those must be used to create signatures for

a valid transaction to spend the funds. At this time, standard

multisignature scripts are limited to at most 15 listed public keys,

meaning you can do anything from a 1-of-1 to a 15-of-15 multisignature

or any combination within that range. The limitation to 15 listed keys

might be lifted by the time this book is published, so check the

isStandard() function to see what is currently accepted by the

network.

The general form of a locking script setting an M-of-N multisignature condition is:

M <Public Key 1> <Public Key 2> ... <Public Key N> N CHECKMULTISIG

where N is the total number of listed public keys and M is the threshold of required signatures to spend the output.

A locking script setting a 2-of-3 multisignature condition looks like this:

2 <Public Key A> <Public Key B> <Public Key C> 3 CHECKMULTISIG

The preceding locking script can be satisfied with an unlocking script containing pairs of signatures and public keys:

<Signature B> <Signature C>

or any combination of two signatures from the private keys corresponding to the three listed public keys.

The two scripts together would form the combined validation script:

<Signature B> <Signature C> 2 <Public Key A> <Public Key B> <Public Key C> 3 CHECKMULTISIG

When executed, this combined script will evaluate to TRUE if, and only if, the unlocking script matches the conditions set by the locking script. In this case, the condition is whether the unlocking script has a valid signature from the two private keys that correspond to two of the three public keys set as an encumbrance.

A bug in CHECKMULTISIG execution

scriptingmultisignature scriptsCHECKMULTISIG bug multisignature

scriptsCHECKMULTISIG bug CHECKMULTISIG bugCHECKMULTISIG bug

workaroundThere is a bug in CHECKMULTISIG's execution that requires a

slight workaround. When CHECKMULTISIG executes, it should consume

M+N+2 items on the stack as parameters. However, due to the bug,

CHECKMULTISIG will pop an extra value or one value more than expected.

Let’s look at this in greater detail using the previous validation example:

<Signature B> <Signature C> 2 <Public Key A> <Public Key B> <Public Key C> 3 CHECKMULTISIG

First, CHECKMULTISIG pops the top item, which is N (in this example

"3"). Then it pops N items, which are the public keys that can sign.

In this example, public keys A, B, and C. Then, it pops one item, which

is M, the quorum (how many signatures are needed). Here M = 2. At this

point, CHECKMULTISIG should pop the final M items, which are the

signatures, and see if they are valid. However, unfortunately, a bug in

the implementation causes CHECKMULTISIG to pop one more item (M+1

total) than it should. The extra item is disregarded when checking the

signatures so it has no direct effect on CHECKMULTISIG itself.

However, an extra value must be present because if it is not present,

when CHECKMULTISIG attempts to pop on an empty stack, it will cause a

stack error and script failure (marking the transaction as invalid).

Because the extra item is disregarded it can be anything, but

customarily 0 is used.

Because this bug became part of the consensus rules, it must now be replicated forever. Therefore the correct script validation would look like this:

0 <Signature B> <Signature C> 2 <Public Key A> <Public Key B> <Public Key C> 3 CHECKMULTISIG

Thus the unlocking script actually used in multisig is not:

<Signature B> <Signature C>

but instead it is:

0 <Signature B> <Signature C>

From now on, if you see a multisig unlocking script, you should expect

to see an extra 0 in the beginning, whose only purpose is as a

workaround to a bug that accidentally became a consensus rule.

Pay-to-Script-Hash (P2SH)

transactionsadvancedPay-to-Script-Hash advancedPay-to-Script-Hash Pay-to-Script-HashscriptingPay-to-Script-Hash Pay-to-Script-HashPay-to-Script-Hash (P2SH) was introduced in 2012 as a powerful new type of transaction that greatly simplifies the use of complex transaction scripts. To explain the need for P2SH, let’s look at a practical example.

use casesimport/export import/exportscriptingPay-to-Script-Hashimport/export example Pay-to-Script-Hashimport/export example import/export examplePay-to-Script-Hash (P2SH)import/export example import/export exampleIn ??? we introduced Mohammed, an electronics importer based in Dubai. Mohammed’s company uses bitcoin’s multisignature feature extensively for its corporate accounts. Multisignature scripts are one of the most common uses of bitcoin’s advanced scripting capabilities and are a very powerful feature. accounts receivable (AR)Mohammed’s company uses a multisignature script for all customer payments, known in accounting terms as "accounts receivable," or AR. With the multisignature scheme, any payments made by customers are locked in such a way that they require at least two signatures to release, from Mohammed and one of his partners or from his attorney who has a backup key. A multisignature scheme like that offers corporate governance controls and protects against theft, embezzlement, or loss.

The resulting script is quite long and looks like this:

2 <Mohammed's Public Key> <Partner1 Public Key> <Partner2 Public Key> <Partner3 Public Key> <Attorney Public Key> 5 CHECKMULTISIG

Although multisignature scripts are a powerful feature, they are cumbersome to use. Given the preceding script, Mohammed would have to communicate this script to every customer prior to payment. Each customer would have to use special bitcoin wallet software with the ability to create custom transaction scripts, and each customer would have to understand how to create a transaction using custom scripts. Furthermore, the resulting transaction would be about five times larger than a simple payment transaction, because this script contains very long public keys. The burden of that extra-large transaction would be borne by the customer in the form of fees. Finally, a large transaction script like this would be carried in the UTXO set in RAM in every full node, until it was spent. All of these issues make using complex locking scripts difficult in practice.

P2SH was developed to resolve these practical difficulties and to make the use of complex scripts as easy as a payment to a bitcoin address. With P2SH payments, the complex locking script is replaced with its digital fingerprint, a cryptographic hash. When a transaction attempting to spend the UTXO is presented later, it must contain the script that matches the hash, in addition to the unlocking script. In simple terms, P2SH means "pay to a script matching this hash, a script that will be presented later when this output is spent."

redeem scriptsscriptingredeem scripts redeem scriptsIn P2SH transactions, the locking script that is replaced by a hash is referred to as the redeem script because it is presented to the system at redemption time rather than as a locking script. table_title shows the script without P2SH and table_title shows the same script encoded with P2SH.

Locking Script |

2 PubKey1 PubKey2 PubKey3 PubKey4 PubKey5 5 CHECKMULTISIG |

Unlocking Script |

Sig1 Sig2 |

Redeem Script |

2 PubKey1 PubKey2 PubKey3 PubKey4 PubKey5 5 CHECKMULTISIG |

Locking Script |

HASH160 <20-byte hash of redeem script> EQUAL |

Unlocking Script |

Sig1 Sig2 <redeem script> |

As you can see from the tables, with P2SH the complex script that details the conditions for spending the output (redeem script) is not presented in the locking script. Instead, only a hash of it is in the locking script and the redeem script itself is presented later, as part of the unlocking script when the output is spent. This shifts the burden in fees and complexity from the sender to the recipient (spender) of the transaction.

Let’s look at Mohammed’s company, the complex multisignature script, and the resulting P2SH scripts.

First, the multisignature script that Mohammed’s company uses for all incoming payments from customers:

2 <Mohammed's Public Key> <Partner1 Public Key> <Partner2 Public Key> <Partner3 Public Key> <Attorney Public Key> 5 CHECKMULTISIG

If the placeholders are replaced by actual public keys (shown here as 520-bit numbers starting with 04) you can see that this script becomes very long:

2

04C16B8698A9ABF84250A7C3EA7EEDEF9897D1C8C6ADF47F06CF73370D74DCCA01CDCA79DCC5C395D7EEC6984D83F1F50C900A24DD47F569FD4193AF5DE762C58704A2192968D8655D6A935BEAF2CA23E3FB87A3495E7AF308EDF08DAC3C1FCBFC2C75B4B0F4D0B1B70CD2423657738C0C2B1D5CE65C97D78D0E34224858008E8B49047E63248B75DB7379BE9CDA8CE5751D16485F431E46117B9D0C1837C9D5737812F393DA7D4420D7E1A9162F0279CFC10F1E8E8F3020DECDBC3C0DD389D99779650421D65CBD7149B255382ED7F78E946580657EE6FDA162A187543A9D85BAAA93A4AB3A8F044DADA618D087227440645ABE8A35DA8C5B73997AD343BE5C2AFD94A5043752580AFA1ECED3C68D446BCAB69AC0BA7DF50D56231BE0AABF1FDEEC78A6A45E394BA29A1EDF518C022DD618DA774D207D137AAB59E0B000EB7ED238F4D800 5 CHECKMULTISIG

This entire script can instead be represented by a 20-byte cryptographic hash, by first applying the SHA256 hashing algorithm and then applying the RIPEMD160 algorithm on the result. The 20-byte hash of the preceding script is:

54c557e07dde5bb6cb791c7a540e0a4796f5e97e

A P2SH transaction locks the output to this hash instead of the longer script, using the locking script:

HASH160 54c557e07dde5bb6cb791c7a540e0a4796f5e97e EQUAL

which, as you can see, is much shorter. Instead of "pay to this 5-key multisignature script," the P2SH equivalent transaction is "pay to a script with this hash." A customer making a payment to Mohammed’s company need only include this much shorter locking script in his payment. When Mohammed and his partners want to spend this UTXO, they must present the original redeem script (the one whose hash locked the UTXO) and the signatures necessary to unlock it, like this:

<Sig1> <Sig2> <2 PK1 PK2 PK3 PK4 PK5 5 CHECKMULTISIG>

The two scripts are combined in two stages. First, the redeem script is checked against the locking script to make sure the hash matches:

<2 PK1 PK2 PK3 PK4 PK5 5 CHECKMULTISIG> HASH160 <redeem scriptHash> EQUAL

If the redeem script hash matches, the unlocking script is executed on its own, to unlock the redeem script:

<Sig1> <Sig2> 2 PK1 PK2 PK3 PK4 PK5 5 CHECKMULTISIG

Almost all the scripts described in this chapter can only be implemented as P2SH scripts. They cannot be used directly in the locking script of a UTXO.

P2SH Addresses

scriptingPay-to-Script-Hashaddresses Pay-to-Script-Hashaddresses

addressesPay-to-Script-Hash (P2SH)addresses addressesbitcoin improvement

proposalsAddress Format for P2SH (BIP-13) Address Format for P2SH

(BIP-13)Another important part of the P2SH feature is the ability to

encode a script hash as an address, as defined in BIP-13. P2SH addresses

are Base58Check encodings of the 20-byte hash of a script, just like

bitcoin addresses are Base58Check encodings of the 20-byte hash of a

public key. P2SH addresses use the version prefix "5," which results in

Base58Check-encoded addresses that start with a "3." For example,

Mohammed’s complex script, hashed and Base58Check-encoded as a P2SH

address, becomes 39RF6JqABiHdYHkfChV6USGMe6Nsr66Gzw. Now, Mohammed can

give this "address" to his customers and they can use almost any bitcoin

wallet to make a simple payment, as if it were a bitcoin address. The 3

prefix gives them a hint that this is a special type of address, one

corresponding to a script instead of a public key, but otherwise it

works in exactly the same way as a payment to a bitcoin address.

P2SH addresses hide all of the complexity, so that the person making a payment does not see the script.

Benefits of P2SH

scriptingPay-to-Script-Hashbenefits of Pay-to-Script-Hashbenefits of benefits ofPay-to-Script-Hash (P2SH)benefits of benefits ofThe P2SH feature offers the following benefits compared to the direct use of complex scripts in locking outputs:

Complex scripts are replaced by shorter fingerprints in the transaction output, making the transaction smaller.

Scripts can be coded as an address, so the sender and the sender’s wallet don’t need complex engineering to implement P2SH.

P2SH shifts the burden of constructing the script to the recipient, not the sender.

P2SH shifts the burden in data storage for the long script from the output (which is in the UTXO set) to the input (stored on the blockchain).

P2SH shifts the burden in data storage for the long script from the present time (payment) to a future time (when it is spent).

P2SH shifts the transaction fee cost of a long script from the sender to the recipient, who has to include the long redeem script to spend it.

Redeem Script and Validation

scriptingPay-to-Script-Hashredeem scripts and validation

Pay-to-Script-Hashredeem scripts and validation redeem scripts and

validationPay-to-Script-Hash (P2SH)redeem scripts and validation redeem

scripts and validationredeem scriptsvalidationPrior to version 0.9.2 of

the Bitcoin Core client, Pay-to-Script-Hash was limited to the standard

types of bitcoin transaction scripts, by the isStandard() function.

That means that the redeem script presented in the spending transaction

could only be one of the standard types: P2PK, P2PKH, or multisig

nature, excluding RETURN and P2SH itself.

As of version 0.9.2 of the Bitcoin Core client, P2SH transactions can contain any valid script, making the P2SH standard much more flexible and allowing for experimentation with many novel and complex types of transactions.

Note that you are not able to put a P2SH inside a P2SH redeem script,

because the P2SH specification is not recursive. While it is technically

possible to include RETURN in a redeem script, as nothing in the rules

prevents you from doing so, it is of no practical use because executing

RETURN during validation will cause the transaction to be marked

invalid.

Note that because the redeem script is not presented to the network until you attempt to spend a P2SH output, if you lock an output with the hash of an invalid redeem script it will be processed regardless. The UTXO will be successfully locked. However, you will not be able to spend it because the spending transaction, which includes the redeem script, will not be accepted because it is an invalid script. This creates a risk, because you can lock bitcoin in a P2SH that cannot be spent later. The network will accept the P2SH locking script even if it corresponds to an invalid redeem script, because the script hash gives no indication of the script it represents.

Warning

warnings and cautionsaccidental bitcoin locking accidental bitcoin lockingP2SH locking scripts contain the hash of a redeem script, which gives no clues as to the content of the redeem script itself. The P2SH transaction will be considered valid and accepted even if the redeem script is invalid. You might accidentally lock bitcoin in such a way that it cannot later be spent.

Data Recording Output (RETURN)

transactionsadvanceddata recording output advanceddata recording output data recording outputscriptingdata recording output data recording outputRETURN operatordata recording (nonpayment data)nonpayment datablockchain (the)nonpayment data recording nonpayment data recordingdigital notary servicesBitcoin’s distributed and timestamped ledger, the blockchain, has potential uses far beyond payments. Many developers have tried to use the transaction scripting language to take advantage of the security and resilience of the system for applications such as digital notary services, stock certificates, and smart contracts. Early attempts to use bitcoin’s script language for these purposes involved creating transaction outputs that recorded data on the blockchain; for example, to record a digital fingerprint of a file in such a way that anyone could establish proof-of-existence of that file on a specific date by reference to that transaction.

blockchain bloatbloatunspent transaction outputs (UTXO)UTXO setsThe use of bitcoin’s blockchain to store data unrelated to bitcoin payments is a controversial subject. Many developers consider such use abusive and want to discourage it. Others view it as a demonstration of the powerful capabilities of blockchain technology and want to encourage such experimentation. Those who object to the inclusion of nonpayment data argue that it causes "blockchain bloat," burdening those running full bitcoin nodes with carrying the cost of disk storage for data that the blockchain was not intended to carry. Moreover, such transactions create UTXO that cannot be spent, using the destination bitcoin address as a freeform 20-byte field. Because the address is used for data, it doesn’t correspond to a private key and the resulting UTXO can never be spent; it’s a fake payment. These transactions that can never be spent are therefore never removed from the UTXO set and cause the size of the UTXO database to forever increase, or "bloat."

In version 0.9 of the Bitcoin Core client, a compromise was reached with

the introduction of the RETURN operator. RETURN allows developers to

add 80 bytes of nonpayment data to a transaction output. However, unlike

the use of "fake" UTXO, the RETURN operator creates an explicitly

provably unspendable output, which does not need to be stored in the

UTXO set. RETURN outputs are recorded on the blockchain, so they

consume disk space and contribute to the increase in the blockchain’s

size, but they are not stored in the UTXO set and therefore do not bloat

the UTXO memory pool and burden full nodes with the cost of more

expensive RAM.

RETURN scripts look like this:

RETURN <data>

Proof of ExistenceDOCPROOF prefixThe data portion is limited to 80 bytes

and most often represents a hash, such as the output from the SHA256

algorithm (32 bytes). Many applications put a prefix in front of the

data to help identify the application. For example, the Proof of

Existence digital notarization service

uses the 8-byte prefix DOCPROOF, which is ASCII encoded as

44 4f 43 50 52 4f 4f 46 in hexadecimal.

Keep in mind that there is no "unlocking script" that corresponds to

RETURN that could possibly be used to "spend" a RETURN output. The

whole point of RETURN is that you can’t spend the money locked in that

output, and therefore it does not need to be held in the UTXO set as

potentially spendable—RETURN is provably unspendable. RETURN is

usually an output with a zero bitcoin amount, because any bitcoin

assigned to such an output is effectively lost forever. If a RETURN is

referenced as an input in a transaction, the script validation engine

will halt the execution of the validation script and mark the

transaction as invalid. The execution of RETURN essentially causes the

script to "RETURN" with a FALSE and halt. Thus, if you accidentally

reference a RETURN output as an input in a transaction, that

transaction is invalid.

A standard transaction (one that conforms to the isStandard() checks)

can have only one RETURN output. However, a single RETURN output can

be combined in a transaction with outputs of any other type.

Two new command-line options have been added in Bitcoin Core as of

version 0.10. The option datacarrier controls relay and mining of

RETURN transactions, with the default set to "1" to allow them. The

option datacarriersize takes a numeric argument specifying the maximum

size in bytes of the RETURN script, 83 bytes by default, which, allows

for a maximum of 80 bytes of RETURN data plus one byte of RETURN

opcode and two bytes of PUSHDATA opcode.

Note

RETURNwas initially proposed with a limit of 80 bytes, but the limit was reduced to 40 bytes when the feature was released. In February 2015, in version 0.10 of Bitcoin Core, the limit was raised back to 80 bytes. Nodes may choose not to relay or mineRETURN, or only relay and mineRETURNcontaining less than 80 bytes of data.

Timelocks

transactionsadvancedtimelocks advancedtimelocks

timelocksscriptingtimelocks timelocksnLocktime

fieldscriptingtimelocksuses for timelocksuses for uses fortimelocksuses

for uses forTimelocks are restrictions on transactions or outputs that

only allow spending after a point in time. Bitcoin has had a

transaction-level timelock feature from the beginning. It is implemented

by the nLocktime field in a transaction. Two new timelock features

were introduced in late 2015 and mid-2016 that offer UTXO-level

timelocks. These are CHECKLOCKTIMEVERIFY and CHECKSEQUENCEVERIFY.

Timelocks are useful for postdating transactions and locking funds to a date in the future. More importantly, timelocks extend bitcoin scripting into the dimension of time, opening the door for complex multistep smart contracts.

Transaction Locktime (nLocktime)

scriptingtimelocksnLocktime timelocksnLocktime

nLocktimetimelocksnLocktime nLocktimeFrom the beginning, bitcoin has had

a transaction-level timelock feature. Transaction locktime is a

transaction-level setting (a field in the transaction data structure)

that defines the earliest time that a transaction is valid and can be

relayed on the network or added to the blockchain. Locktime is also

known as nLocktime from the variable name used in the Bitcoin Core

codebase. It is set to zero in most transactions to indicate immediate

propagation and execution. If nLocktime is nonzero and below 500

million, it is interpreted as a block height, meaning the transaction is

not valid and is not relayed or included in the blockchain prior to the

specified block height. If it is above 500 million, it is interpreted as

a Unix Epoch timestamp (seconds since Jan-1-1970) and the transaction is

not valid prior to the specified time. Transactions with nLocktime

specifying a future block or time must be held by the originating system

and transmitted to the bitcoin network only after they become valid. If

a transaction is transmitted to the network before the specified

nLocktime, the transaction will be rejected by the first node as

invalid and will not be relayed to other nodes. The use of nLocktime

is equivalent to postdating a paper check.

Transaction locktime limitations

nLocktime has the limitation that while it makes it possible to spend

some outputs in the future, it does not make it impossible to spend them

until that time. Let’s explain that with the following example.

use casesbuying coffee buying coffeeAlice signs a transaction spending

one of her outputs to Bob’s address, and sets the transaction

nLocktime to 3 months in the future. Alice sends that transaction to

Bob to hold. With this transaction Alice and Bob know that:

Bob cannot transmit the transaction to redeem the funds until 3 months have elapsed.

Bob may transmit the transaction after 3 months.

However:

Alice can create another transaction, double-spending the same inputs without a locktime. Thus, Alice can spend the same UTXO before the 3 months have elapsed.

Bob has no guarantee that Alice won’t do that.

It is important to understand the limitations of transaction

nLocktime. The only guarantee is that Bob will not be able to redeem

it before 3 months have elapsed. There is no guarantee that Bob will get

the funds. To achieve such a guarantee, the timelock restriction must be

placed on the UTXO itself and be part of the locking script, rather than

on the transaction. This is achieved by the next form of timelock,

called Check Lock Time Verify.

Check Lock Time Verify (CLTV)

Check Lock Time Verify (CLTV)timelocksCheck Lock Time Verify (CLTV)

Check Lock Time Verify (CLTV)scriptingtimelocksCheck Lock Time Verify

(CLTV) timelocksCheck Lock Time Verify (CLTV) Check Lock Time Verify

(CLTV)bitcoin improvement proposalsCHECKLOCKTIMEVERIFY (BIP-65)

CHECKLOCKTIMEVERIFY (BIP-65)In December 2015, a new form of timelock was

introduced to bitcoin as a soft fork upgrade. Based on a specifications

in BIP-65, a new script operator called CHECKLOCKTIMEVERIFY (CLTV)

was added to the scripting language. CLTV is a per-output timelock,

rather than a per-transaction timelock as is the case with nLocktime.

This allows for much greater flexibility in the way timelocks are

applied.

In simple terms, by adding the CLTV opcode in the redeem script of an

output it restricts the output, so that it can only be spent after the

specified time has elapsed.

Tip

While

nLocktimeis a transaction-level timelock,CLTVis an output-based timelock.

CLTV doesn’t replace nLocktime, but rather restricts specific UTXO

such that they can only be spent in a future transaction with

nLocktime set to a greater or equal value.

The CLTV opcode takes one parameter as input, expressed as a number in

the same format as nLocktime (either a block height or Unix epoch

time). As indicated by the VERIFY suffix, CLTV is the type of opcode

that halts execution of the script if the outcome is FALSE. If it

results in TRUE, execution continues.

In order to lock an output with CLTV, you insert it into the redeem

script of the output in the transaction that creates the output. For

example, if Alice is paying Bob’s address, the output would normally

contain a P2PKH script like this:

DUP HASH160 <Bob's Public Key Hash> EQUALVERIFY CHECKSIG

To lock it to a time, say 3 months from now, the transaction would be a P2SH transaction with a redeem script like this:

<now + 3 months> CHECKLOCKTIMEVERIFY DROP DUP HASH160 <Bob's Public Key Hash> EQUALVERIFY CHECKSIG

where <now + 3 months> is a block height or time value estimated 3

months from the time the transaction is mined: current block height +

12,960 (blocks) or current Unix epoch time + 7,760,000 (seconds). For

now, don’t worry about the DROP opcode that follows

CHECKLOCKTIMEVERIFY; it will be explained shortly.

When Bob tries to spend this UTXO, he constructs a transaction that

references the UTXO as an input. He uses his signature and public key in

the unlocking script of that input and sets the transaction nLocktime

to be equal or greater to the timelock in the CHECKLOCKTIMEVERIFY

Alice set. Bob then broadcasts the transaction on the bitcoin network.

Bob’s transaction is evaluated as follows. If the CHECKLOCKTIMEVERIFY

parameter Alice set is less than or equal the spending transaction’s

nLocktime, script execution continues (acts as if a “no operation” or

NOP opcode was executed). Otherwise, script execution halts and the

transaction is deemed invalid.

More precisely, CHECKLOCKTIMEVERIFY fails and halts execution, marking

the transaction invalid if (source: BIP-65):

the stack is empty; or

the top item on the stack is less than 0; or

the lock-time type (height versus timestamp) of the top stack item and the

nLocktimefield are not the same; orthe top stack item is greater than the transaction’s

nLocktimefield; orthe

nSequencefield of the input is 0xffffffff.

Note

CLTVandnLocktimeuse the same format to describe timelocks, either a block height or the time elapsed in seconds since Unix epoch. Critically, when used together, the format ofnLocktimemust match that ofCLTVin the inputs—they must both reference either block height or time in seconds.

After execution, if CLTV is satisfied, the time parameter that

preceded it remains as the top item on the stack and may need to be

dropped, with DROP, for correct execution of subsequent script

opcodes. You will often see CHECKLOCKTIMEVERIFY followed by DROP in

scripts for this reason.

By using nLocktime in conjunction with CLTV, the scenario described in

section_title changes. Because Alice locked

the UTXO itself, it is now impossible for either Bob or Alice to spend

it before the 3-month locktime has expired.

By introducing timelock functionality directly into the scripting

language, CLTV allows us to develop some very interesting complex

scripts.

The standard is defined in BIP-65 (CHECKLOCKTIMEVERIFY).

Relative Timelocks

nLocktime and CLTV are timelocksrelative timelocks relative

timelocksscriptingtimelocksrelative timelocks timelocksrelative

timelocks relative timelocksrelative timelocksboth absolute timelocks

in that they specify an absolute point in time. The next two timelock

features we will examine are relative timelocks in that they specify,

as a condition of spending an output, an elapsed time from the

confirmation of the output in the blockchain.

Relative timelocks are useful because they allow a chain of two or more interdependent transactions to be held off chain, while imposing a time constraint on one transaction that is dependent on the elapsed time from the confirmation of a previous transaction. In other words, the clock doesn’t start counting until the UTXO is recorded on the blockchain. This functionality is especially useful in bidirectional state channels and Lightning Networks, as we will see in ???.

Relative timelocks, like absolute timelocks, are implemented with both a

transaction-level feature and a script-level opcode. The

transaction-level relative timelock is implemented as a consensus rule

on the value of nSequence, a transaction field that is set in every

transaction input. Script-level relative timelocks are implemented with

the CHECKSEQUENCEVERIFY (CSV) opcode.

bitcoin improvement proposalsRelative lock-time using consensus-enforced sequence numbers (BIP-68) Relative lock-time using consensus-enforced sequence numbers (BIP-68)bitcoin improvement proposalsCHECKSEQUENCEVERIFY (BIP-112) CHECKSEQUENCEVERIFY (BIP-112)Relative timelocks are implemented according to the specifications in BIP-68, Relative lock-time using consensus-enforced sequence numbers and BIP-112, CHECKSEQUENCEVERIFY.

BIP-68 and BIP-112 were activated in May 2016 as a soft fork upgrade to the consensus rules.

Relative Timelocks with nSequence

nSequence fieldscriptingtimelocksrelative timelocks with nSequence

timelocksrelative timelocks with nSequence relative timelocks with

nSequenceRelative timelocks can be set on each input of a transaction,

by setting the nSequence field in each input.

Original meaning of nSequence

The nSequence field was originally intended (but never properly

implemented) to allow modification of transactions in the mempool. In

that use, a transaction containing inputs with nSequence value below

232 - 1 (0xFFFFFFFF) indicated a transaction that was not yet

"finalized." Such a transaction would be held in the mempool until it

was replaced by another transaction spending the same inputs with a

higher nSequence value. Once a transaction was received whose inputs

had an nSequence value of 0xFFFFFFFF it would be considered

"finalized" and mined.

The original meaning of nSequence was never properly implemented and

the value of nSequence is customarily set to 0xFFFFFFFF in

transactions that do not utilize timelocks. For transactions with

nLocktime or CHECKLOCKTIMEVERIFY, the nSequence value must be set to

less than 231 for the timelock guards to have effect, as

explained below.

nSequence as a consensus-enforced relative timelock

Since the activation of BIP-68, new consensus rules apply for any

transaction containing an input whose nSequence value is less than

231 (bit 1<<31 is not set). Programmatically, that

means that if the most significant (bit 1<<31) is not set, it is a

flag that means "relative locktime." Otherwise (bit 1<<31 set),

the nSequence value is reserved for other uses such as enabling

CHECKLOCKTIMEVERIFY, nLocktime, Opt-In-Replace-By-Fee, and other

future developments.

Transaction inputs with nSequence values less than 231 are

interpreted as having a relative timelock. Such a transaction is only

valid once the input has aged by the relative timelock amount. For

example, a transaction with one input with an nSequence relative

timelock of 30 blocks is only valid when at least 30 blocks have elapsed

from the time the UTXO referenced in the input was mined. Since

nSequence is a per-input field, a transaction may contain any number

of timelocked inputs, all of which must have sufficiently aged for the

transaction to be valid. A transaction can include both timelocked

inputs (nSequence < 231) and inputs without a relative

timelock (nSequence >= 231).

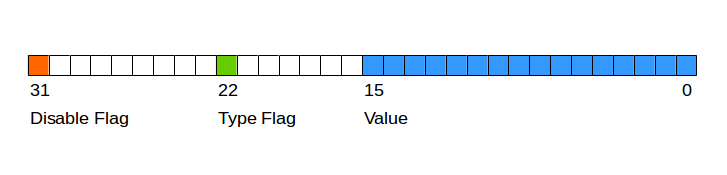

The nSequence value is specified in either blocks or seconds, but in a

slightly different format than we saw used in nLocktime. A type-flag

is used to differentiate between values counting blocks and values

counting time in seconds. The type-flag is set in the 23rd

least-significant bit (i.e., value 1<<22). If the type-flag is

set, then the nSequence value is interpreted as a multiple of 512

seconds. If the type-flag is not set, the nSequence value is

interpreted as a number of blocks.

When interpreting nSequence as a relative timelock, only the 16 least

significant bits are considered. Once the flags (bits 32 and 23) are

evaluated, the nSequence value is usually "masked" with a 16-bit mask

(e.g., nSequence & 0x0000FFFF).

figure_title shows the binary layout of the

nSequence value, as defined by BIP-68.

Relative timelocks based on consensus enforcement of the nSequence

value are defined in BIP-68.

The standard is defined in BIP-68, Relative lock-time using consensus-enforced sequence numbers.

Relative Timelocks with CSV

scriptingtimelocksrelative timelocks with CHECKSEQUENCEVERIFY

timelocksrelative timelocks with CHECKSEQUENCEVERIFY relative timelocks

with CHECKSEQUENCEVERIFYCHECKSEQUENCEVERIFY (CSV)Just like CLTV and

nLocktime, there is a script opcode for relative timelocks that

leverages the nSequence value in scripts. That opcode is

CHECKSEQUENCEVERIFY, commonly referred to as CSV for short.

The CSV opcode when evaluated in a UTXO’s redeem script allows

spending only in a transaction whose input nSequence value is greater

than or equal to the CSV parameter. Essentially, this restricts

spending the UTXO until a certain number of blocks or seconds have

elapsed relative to the time the UTXO was mined.

As with CLTV, the value in CSV must match the format in the

corresponding nSequence value. If CSV is specified in terms of

blocks, then so must nSequence. If CSV is specified in terms of

seconds, then so must nSequence.

Relative timelocks with CSV are especially useful when several

(chained) transactions are created and signed, but not propagated, when

they’re kept "off-chain." A child transaction cannot be used until the

parent transaction has been propagated, mined, and aged by the time

specified in the relative timelock. One application of this use case can

be seen in ??? and ???.

CSV is defined in detail in BIP-112,

CHECKSEQUENCEVERIFY.

Median-Time-Past

scriptingtimelocksMedian-Tme-Past timelocksMedian-Tme-Past Median-Tme-PastMedian-Tme-PasttimelocksMedian-Tme-Past Median-Tme-PastAs part of the activation of relative timelocks, there was also a change in the way "time" is calculated for timelocks (both absolute and relative). In bitcoin there is a subtle, but very significant, difference between wall time and consensus time. Bitcoin is a decentralized network, which means that each participant has his or her own perspective of time. Events on the network do not occur instantaneously everywhere. Network latency must be factored into the perspective of each node. Eventually everything is synchronized to create a common ledger. Bitcoin reaches consensus every 10 minutes about the state of the ledger as it existed in the past.

The timestamps set in block headers are set by the miners. There is a certain degree of latitude allowed by the consensus rules to account for differences in clock accuracy between decentralized nodes. However, this creates an unfortunate incentive for miners to lie about the time in a block so as to earn extra fees by including timelocked transactions that are not yet mature. See the following section for more information.

To remove the incentive to lie and strengthen the security of timelocks, a BIP was proposed and activated at the same time as the BIPs for relative timelocks. This is BIP-113, which defines a new consensus measurement of time called Median-Time-Past.

Median-Time-Past is calculated by taking the timestamps of the last 11 blocks and finding the median. That median time then becomes consensus time and is used for all timelock calculations. By taking the midpoint from approximately two hours in the past, the influence of any one block’s timestamp is reduced. By incorporating 11 blocks, no single miner can influence the timestamps in order to gain fees from transactions with a timelock that hasn’t yet matured.

Median-Time-Past changes the implementation of time calculations for

nLocktime, CLTV, nSequence, and CSV. The consensus time

calculated by Median-Time-Past is always approximately one hour behind

wall clock time. If you create timelock transactions, you should account

for it when estimating the desired value to encode in nLocktime,

nSequence, CLTV, and CSV.

Median-Time-Past is specified in BIP-113.

Timelock Defense Against Fee Sniping

scriptingtimelocksdefense against fee-sniping timelocksdefense against fee-sniping defense against fee-snipingtimelocksdefense against fee-sniping defense against fee-snipingfeesfee sniping fee snipingsecuritydefense against fee-sniping defense against fee-snipingsnipingFee-sniping is a theoretical attack scenario, where miners attempting to rewrite past blocks "snipe" higher-fee transactions from future blocks to maximize their profitability.

For example, let’s say the highest block in existence is block #100,000. If instead of attempting to mine block #100,001 to extend the chain, some miners attempt to remine #100,000. These miners can choose to include any valid transaction (that hasn’t been mined yet) in their candidate block #100,000. They don’t have to remine the block with the same transactions. In fact, they have the incentive to select the most profitable (highest fee per kB) transactions to include in their block. They can include any transactions that were in the "old" block #100,000, as well as any transactions from the current mempool. Essentially they have the option to pull transactions from the "present" into the rewritten "past" when they re-create block #100,000.

Today, this attack is not very lucrative, because block reward is much higher than total fees per block. But at some point in the future, transaction fees will be the majority of the reward (or even the entirety of the reward). At that time, this scenario becomes inevitable.

To prevent "fee sniping," when Bitcoin Core creates transactions, it

uses nLocktime to limit them to the "next block," by default. In our

scenario, Bitcoin Core would set nLocktime to 100,001 on any

transaction it created. Under normal circumstances, this nLocktime has

no effect—the transactions could only be included in block #100,001

anyway; it’s the next block.

But under a blockchain fork attack, the miners would not be able to pull high-fee transactions from the mempool, because all those transactions would be timelocked to block #100,001. They can only remine #100,000 with whatever transactions were valid at that time, essentially gaining no new fees.

To achieve this, Bitcoin Core sets the nLocktime on all new

transactions to <current block # + 1> and sets the nSequence on

all the inputs to 0xFFFFFFFE to enable nLocktime.

Scripts with Flow Control (Conditional Clauses)

transactionsadvancedflow control scripts advancedflow control scripts

flow control scriptsscriptingflow control scripts flow control

scriptsconditional clausesflow controlOne of the more powerful features

of Bitcoin Script is flow control, also known as conditional clauses.

You are probably familiar with flow control in various programming

languages that use the construct IF…THEN…ELSE. Bitcoin conditional

clauses look a bit different, but are essentially the same construct.

At a basic level, bitcoin conditional opcodes allow us to construct a

redeem script that has two ways of being unlocked, depending on a

TRUE/FALSE outcome of evaluating a logical condition. For example,

if x is TRUE, the redeem script is A and the ELSE redeem script is B.

Additionally, bitcoin conditional expressions can be "nested" indefinitely, meaning that a conditional clause can contain another within it, which contains another, etc. Bitcoin Script flow control can be used to construct very complex scripts with hundreds or even thousands of possible execution paths. There is no limit to nesting, but consensus rules impose a limit on the maximum size, in bytes, of a script.

Bitcoin implements flow control using the IF, ELSE, ENDIF, and

NOTIF opcodes. Additionally, conditional expressions can contain

boolean operators such as BOOLAND, BOOLOR, and NOT.

At first glance, you may find the bitcoin’s flow control scripts

confusing. That is because Bitcoin Script is a stack language. The same

way that 1 + 1 looks "backward" when expressed as 1 1 ADD, flow

control clauses in bitcoin also look "backward."

In most traditional (procedural) programming languages, flow control looks like this:

Pseudocode of flow control in most programming languages.

if (condition):

code to run when condition is true

else:

code to run when condition is false

code to run in either case

In a stack-based language like Bitcoin Script, the logical condition

comes before the IF, which makes it look "backward," like this:

Bitcoin Script flow control.

condition

IF

code to run when condition is true

ELSE

code to run when condition is false

ENDIF

code to run in either case

When reading Bitcoin Script, remember that the condition being evaluated

comes before the IF opcode.

Conditional Clauses with VERIFY Opcodes

VERIFY opcodesIF clausesopcodesVERIFY VERIFYAnother form of conditional

in Bitcoin Script is any opcode that ends in VERIFY. The VERIFY

suffix means that if the condition evaluated is not TRUE, execution of

the script terminates immediately and the transaction is deemed invalid.

guard clausesUnlike an IF clause, which offers alternative execution

paths, the VERIFY suffix acts as a guard clause, continuing only if

a precondition is met.

For example, the following script requires Bob’s signature and a pre-image (secret) that produces a specific hash. Both conditions must be satisfied to unlock:

A redeem script with an EQUALVERIFY guard clause..

HASH160 <expected hash> EQUALVERIFY <Bob's Pubkey> CHECKSIG

To redeem this, Bob must construct an unlocking script that presents a valid pre-image and a signature:

An unlocking script to satisfy the above redeem script.

<Bob's Sig> <hash pre-image>

Without presenting the pre-image, Bob can’t get to the part of the script that checks for his signature.

This script can be written with an IF instead:

A redeem script with an IF guard clause.

HASH160 <expected hash> EQUAL

IF

<Bob's Pubkey> CHECKSIG

ENDIF

Bob’s unlocking script is identical:

An unlocking script to satisfy the above redeem script.

<Bob's Sig> <hash pre-image>

The script with IF does the same thing as using an opcode with a

VERIFY suffix; they both operate as guard clauses. However, the

VERIFY construction is more efficient, using one fewer opcode.

So, when do we use VERIFY and when do we use IF? If all we are

trying to do is to attach a precondition (guard clause), then VERIFY

is better. If, however, we want to have more than one execution path

(flow control), then we need an IF…ELSE flow control clause.

Tip

EQUAL opcodeopcodesEQUAL EQUALEQUALVERIFY opcodeopcodesEQUALVERIFY EQUALVERIFYAn opcode such as

EQUALwill push the result (TRUE/FALSE) onto the stack, leaving it there for evaluation by subsequent opcodes. In contrast, the opcodeEQUALVERIFYsuffix does not leave anything on the stack. Opcodes that end inVERIFYdo not leave the result on the stack.

Using Flow Control in Scripts

A very common use for flow control in Bitcoin Script is to construct a redeem script that offers multiple execution paths, each a different way of redeeming the UTXO.

use casesbuying coffee buying coffeeLet’s look at a simple example,

where we have two signers, Alice and Bob, and either one is able to

redeem. With multisig, this would be expressed as a 1-of-2 multisig

script. For the sake of demonstration, we will do the same thing with an

IF clause:

IF

<Alice's Pubkey> CHECKSIG

ELSE

<Bob's Pubkey> CHECKSIG

ENDIF

Looking at this redeem script, you may be wondering: "Where is the

condition? There is nothing preceding the IF clause!"

The condition is not part of the redeem script. Instead, the condition will be offered in the unlocking script, allowing Alice and Bob to "choose" which execution path they want.

Alice redeems this with the unlocking script:

<Alice's Sig> 1

The 1 at the end serves as the condition (TRUE) that will make the

IF clause execute the first redemption path for which Alice has a

signature.

For Bob to redeem this, he would have to choose the second execution

path by giving a FALSE value to the IF clause:

<Bob's Sig> 0

Bob’s unlocking script puts a 0 on the stack, causing the IF clause

to execute the second (ELSE) script, which requires Bob’s signature.

Since IF clauses can be nested, we can create a "maze" of execution

paths. The unlocking script can provide a "map" selecting which

execution path is actually executed:

IF

script A

ELSE

IF

script B

ELSE

script C

ENDIF

ENDIF

In this scenario, there are three execution paths (script A,

script B, and script C). The unlocking script provides a path in the

form of a sequence of TRUE or FALSE values. To select path

script B, for example, the unlocking script must end in 1 0 (TRUE,

FALSE). These values will be pushed onto the stack, so that the second

value (FALSE) ends up at the top of the stack. The outer IF clause

pops the FALSE value and executes the first ELSE clause. Then the

TRUE value moves to the top of the stack and is evaluated by the inner

(nested) IF, selecting the B execution path.

Using this construct, we can build redeem scripts with tens or hundreds

of execution paths, each offering a different way to redeem the UTXO. To

spend, we construct an unlocking script that navigates the execution

path by putting the appropriate TRUE and FALSE values on the stack

at each flow control point.

Complex Script Example

transactionsadvancedexample advancedexample examplescriptingcomplex script example complex script exampleIn this section we combine many of the concepts from this chapter into a single example.

use casesimport/export import/exportOur example uses the story of Mohammed, the company owner in Dubai who is operating an import/export business.

transactionsadvancedmultisignature scripts advancedmultisignature scripts multisignature scriptsscriptingmultisignature scriptsimport/export example multisignature scriptsimport/export example import/export examplemultisignature scriptsIn this example, Mohammed wishes to construct a company capital account with flexible rules. The scheme he creates requires different levels of authorization depending on timelocks. The participants in the multisig scheme are Mohammed, his two partners Saeed and Zaira, and their company lawyer Abdul. The three partners make decisions based on a majority rule, so two of the three must agree. However, in the case of a problem with their keys, they want their lawyer to be able to recover the funds with one of the three partner signatures. Finally, if all partners are unavailable or incapacitated for a while, they want the lawyer to be able to manage the account directly.

Here’s the script that Mohammed designs to achieve this:

Variable Multi-Signature with Timelock.

IF

IF

2

ELSE

<30 days> CHECKSEQUENCEVERIFY DROP

<Abdul the Lawyer's Pubkey> CHECKSIGVERIFY

1

ENDIF

<Mohammed's Pubkey> <Saeed's Pubkey> <Zaira's Pubkey> 3 CHECKMULTISIG

ELSE

<90 days> CHECKSEQUENCEVERIFY DROP

<Abdul the Lawyer's Pubkey> CHECKSIG

ENDIF

Mohammed’s script implements three execution paths using nested

IF…ELSE flow control clauses.

In the first execution path, this script operates as a simple 2-of-3

multisig with the three partners. This execution path consists of lines

3 and 9. Line 3 sets the quorum of the multisig to 2 (2-of-3). This

execution path can be selected by putting TRUE TRUE at the end of the

unlocking script:

Unlocking script for the first execution path (2-of-3 multisig).

0 <Mohammed's Sig> <Zaira's Sig> TRUE TRUE

Tip

The

0at the beginning of this unlocking script is because of a bug inCHECKMULTISIGthat pops an extra value from the stack. The extra value is disregarded by theCHECKMULTISIG, but it must be present or the script fails. Pushing0(customarily) is a workaround to the bug, as described in section_title.

The second execution path can only be used after 30 days have elapsed

from the creation of the UTXO. At that time, it requires the signature

of Abdul the lawyer and one of the three partners (a 1-of-3 multisig).

This is achieved by line 7, which sets the quorum for the multisig to

1. To select this execution path, the unlocking script would end in

FALSE TRUE:

Unlocking script for the second execution path (Lawyer + 1-of-3).

0 <Saeed's Sig> <Abdul's Sig> FALSE TRUE

Tip

Why

FALSE TRUE? Isn’t that backward? Because the two values are pushed on to the stack, withFALSEpushed first, thenTRUEpushed second.TRUEis therefore popped first by the firstIFopcode.

Finally, the third execution path allows Abdul the lawyer to spend the

funds alone, but only after 90 days. To select this execution path, the

unlocking script has to end in FALSE:

Unlocking script for the third execution path (Lawyer only).

<Abdul's Sig> FALSE

Try running the script on paper to see how it behaves on the stack.

A few more things to consider when reading this example. See if you can find the answers:

Why can’t the lawyer redeem the third execution path at any time by selecting it with

FALSEon the unlocking script?How many execution paths can be used 5, 35, and 105 days, respectively, after the UTXO is mined?

Are the funds lost if the lawyer loses his key? Does your answer change if 91 days have elapsed?

How do the partners "reset" the clock every 29 or 89 days to prevent the lawyer from accessing the funds?

Why do some

CHECKSIGopcodes in this script have theVERIFYsuffix while others don’t?